A secure and effective payment gateway is a must for every webstore. It minimizes the possibility of online payment fraud, provides smooth transactions and is usually easy to maintain. Magento allows you to install a variety of payment getaways.

Figuring out the right one can determine the success of your online business and security of your Magento payments.

Want to make your checkout faster?

Here are a few checkout optimisation techniques from GoMage to experience less abandonment rates.

In this article, you will learn in detail about five Magento 2 payment gateways. (Since a lot of merchants are moving towards or have already transitioned to Magento 2, we will mostly refer to this version of Magento).

- PayPal.

- SagePay.

- WorldPay.

- Klarna.

- Adyen.

But first, let’s look into the basics of Magento payments.

What is a Payment Gateway?

Payment gateway is a technology that caters as a bridge between a customer’s and your business’s bank account. One of its vital characteristics is to make a said transaction secure and quick. Apart from that, payment gateways usually offer a variety of payment methods, including different types of credit and debit cards, Apple Pay or even Bitcoin.

How Does the Payment Gateway Work?

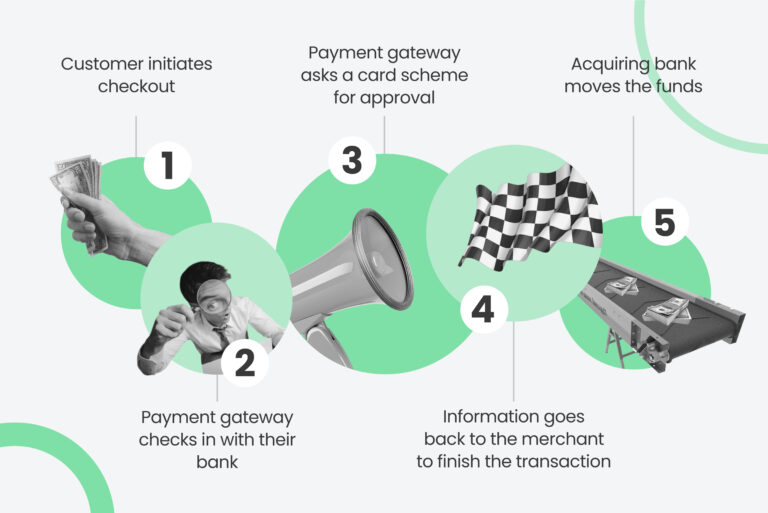

Let’s see how every Magento payment gateway would work in slo-mo. Though in real life, all these steps take only a few seconds.

All the Magento payments start with a customer initiating a checkout, for instance, by pressing a “Pay now” button. That’s how every payment gateway gets activated.

First, the system checks in with the customer bank; does this shopper have enough money on their account? Will the payment exceed their credit limit? If everything is in order, the payment gateway connects with a card scheme of the shopper (like Visa or Mastercard) requesting the transaction.

After that, the payment gateway sends the encrypted information to the merchant’s website to finish the Magento payment processing; then data goes to the acquiring bank which moves the funds from the customer’s account to the business’s.

Payment Methods in Magento

Before jumping into the detailed descriptions, we’d like to talk a bit more about payment methods in Magento. It’s important to understand how payment methods are different from payment gateways.

Payment gateway is a tool which connects all of the parties enabling Magento payment processing services, while a payment method provides a way in which a merchant can collect money: cash, credit/debit cards, mobile payment options like Apple Pay and others.

Payment methods in Magento include payments via check, bank transfers, money orders, cash on delivery and purchase orders. These are the default Magento payment methods. In the following passages, we will talk more about Magento 2 payment methods supported by each of the payment gateways.

Magento 2 Payment Fees

Magento 2 also allows shop owners to add extra charges to the payment methods of their choice. This feature is available with the Magento 2 Payment Fees extension. Magento 2 payment fees, which have to be set up by the admin of the store, can include:

- Product fees.

- Category fees.

- Order fees.

- Payment fees.

Store owners can add multiple percentage-based Magento 2 payment fees for one product.

As for Magento transaction fees, the company doesn’t charge any. All of the fees come from the Magento payment gateways providers. We will talk about their prices in detail in the next section.

Best Magento 2 Payment Gateways: Description and Comparison

We’ll analyze Magento 2 payment gateways by four main criteria:

- Supported Magento Payment methods

- Security features

- Pricing

- Standout Features

PayPal

This is a default and probably the most popular Magento 2 payment gateway; in total, PayPal has more than 377 million accounts worldwide which makes it the biggest company on the market. PayPal Pro is the business version of this payment gateway provider. It will be a good fit for small and medium businesses, as well as for big enterprises.

Payment methods. PayPal accepts American Express, Mastercard, Visa, Venmo, PayPal Credit and other credit/debit cards, bank transfers, phone payments, and in-person payments in 26 currencies from 202 countries. You can also send money using just your email address.

Security. This Magento payment gateway offers advanced encryption, 24-hour monitoring, email confirmations and two-factor authentication.

Pricing. PayPal Pro subscription costs $35 per month; the company will also charge you 2,9% for each transaction plus take fixed fees ($0.30 for the US or €0.35 for Europe) for domestic transactions.

Standout Features. With PayPal Pro, you can customize your checkout process and design your checkout page. It allows you to configure the account in any way you like. This Magento payment gateway is compatible with any device; you can have invoices sent to your mobile phone, computer or tablet.

As opposed to the popular misconception, your customer doesn’t need to have a PayPal account to make Magento payments via this service on your website. PayPal is one of the fastest payment gateways in Magento 2 and overall.

Not enough speed on your Magento 2?

Read how to boost your Magento performance.

SagePay (Opayo)

Another payment gateway supported by Magento 2, SagePay, has now rebranded as Opayo. This Magento payment gateway is recognized by all the major banks and credit card companies and accepts 25+ currencies. With a possibility to be integrated into Magento 2, SagePay is a great option for Europe-based businesses, since it’s a UK company.

Payment methods. Magento 2 SagePay supports Mastercard, Visa, American Express, Maestro payment cards, and a few global payment networks like Discover, Sofort, Giropay, iDeal, epc and JCB.

Security. This Magento payments provider offers information encryption, address and postcode verification, 3D secure tool and an enhanced fraud screening tool which is trained to spot anomalies while checking your customers’ data.

Pricing. SagePay charges a 2.5% transaction fee for all major credit cards and a flat fee of £25 ($32) + VAT per month for up to 333 transactions.

Standout Features. SagePay provides a virtual terminal which lets you handle refunds and manual payments. Like PayPal, SagePay is pretty customizable and allows you to design the SagePay checkout form, redirect your customers to another page or, on the contrary, keep their journey seamless.

Worldpay

The next payment gateway which can be integrated into Magento 2, WorldPay, is the UK’s biggest payment provider. This Magento 2 payment gateway has been on the market for over 25 years, and now accepts payments in 120 currencies around the world. It’s suitable for businesses of all sizes.

Payment methods. Magento 2 Worldpay allows you to use both credit and debit cards, like American Express, MasterCard, Visa, Diners Club, Discover and JCB. It also supports PayPal payments, gift cards and digital wallets compatible with Magento 2 (Apple Pay or Google Pay).

Security. Supported by Magento 2, Worldpay has a security risk feature which monitors the transactions and is always ready to alert the merchants about anything suspicious. This Magento payment gateway also prides itself in its secure servers which can safely transfer sensitive card details.

Pricing. Worldpay offers a tiered pricing structure. There are three versions of Worldpay: Gateway Standard which costs £19 ($25) per month, Gateway Advanced which is £45 ($58), and Gateway Enterprise. The latter’s price has to be discussed with the company.

The Worldpay prices are above average in the industry. Some merchants blame Worldpay for unexpected fees and lack of upfront pricing, so before going ahead with this payment gateway, make sure to do your research.

Standout Features. Magento 2 Worldpay is equipped with some great features like an analytics and reporting tool called Worldpay iQ. It allows merchants to track their payment data, view sales reports and payment history. This Magento payment gateway also offers its own gift card program.

Klarna

Klarna, a Swedish payment gateway, is one of the biggest in Europe. It caters to 60 Million people in 14 different countries and is the largest provider of “buy now, pay later” services in the world.

Payment methods. Klarna supports all debit and credit cards (except the prepaid ones): Visa, Discover, AMEX, Maestro and Mastercard.

Security. Klarna positions itself as one of the safest Magento payment options. The company makes sure its users go through credit card checks before setting up accounts.

Pricing. Klarna offers different prices for different markets. For instance, the US businesses pay a flat fee of $0.30 and a percentage fee from 3.29% to 5.99%. Merchants from the UK are charged 2.49% + 20p ($0.30) per transaction.

Standout Features. Klarna offers a lot more payment flexibility than other payment gateways in Magento 2. This Magento 2 payment gateway enables your customers to pay for their purchases in portions. Shoppers can also send their payments in 30 days or even in 36 months if they are buying something giant.

If your customers are late with their payments, there is no risk for your business, since Klarna will always pay you upfront. For more information about Klarna installment payments, check out their website.

Adyen

Adyen is a Dutch company that offers a lot of finance-related services; and being a payment gateway in Magento 2 is one of them. Adyen is a big name in Europe; however, it’s also available in the US, Canada, Australia, Brazil and Singapore. Since 2018, Adyen has been eBay’s primary partner for payments processing. This Magento 2 payment gateway will be a great fit for large businesses.

Payment methods. Adyen offers almost 80 payment methods, including major debit and credit cards, PayPal, Klarna, and dozens of other services in different countries.

Security. This Magento payments provider offers two encryption solutions: Point-to-Point Encryption, which is standard for the Payment Card Industry, and its own End-to-End Encryption (E2EE). The latter one is positioned to be more secure and requires less operational effort preventing anyone from gaining access to sensitive payment data. Apart from that, Adyen is equipped with an AI powered risk system which makes your clients’ Magento payments safe.

Pricing. Adyen’s monthly fees will depend on your world region, country and payment method. This payment gateway charges a percentage acquirer fee, which starts from 0,6% per transaction, and a payment method fee (from 0,12%). Adyen doesn’t charge monthly or annual fees.

Standout Features. Adyen is also very customizable. It’s a great choice for both B2B and B2C businesses. You can create your own payment flows, layouts, receipts and set up Magento recurring payments. However, bear in mind that Adyen is very developer-oriented, so you may need a well-trained tech specialist to help you integrate this payment gateway in Magento 2.

How To Integrate a Payment Gateway In Magento 2?

Adding new payment gateways in Magento 2 may take some time even if you decide to choose a default one, like PayPal. To change Magento 2 payment options, go to your admin panel and follow this route: Stores > Configuration > Sales Payment Methods.

After pressing ‘Configure’, you will see a few sections to fill in. Here is a short description of the main ones.

Required PayPal Settings

Enter your email, API Username, API Password, API Signature and the credentials from the sandbox account; enable PayPal payments and set ‘API Uses Proxy’.

Basic Settings

Specify the title the shoppers will see at the checkout, select the appropriate payment action and the position of PayPal in the list of other payment methods.

Advanced Settings

Allow displaying PayPal in the shopping cart, enable PayPal in the countries of your choice, set options for requesting customers’ billing address, determine when customers should sign a billing agreement, and determine whether your customers can skip ‘The review of the order’ step.

After that, you will need to finish the PayPal ‘Billing Agreement Settings’, ‘Settlement report Settings’ and ‘Frontend Experience Settings’.

You can always hire a Magento developer to help you with the installment of this or the other Magento 2 payment gateways. Most of them are not default and can be difficult to integrate, especially if you don’t have technical skills. Magento development agencies can give you a hand with choosing Magento payment plugin and Magento payment integration service to make your checkout secure and quick.

Checkout process can make a huge difference for your conversions. To make it more effective, consider turning to custom Magento development services.

Conclusion

Choosing the right Magento payment option isn’t an easy job: it requires a lot of research. You have to know where your customers live, what payment methods they prefer, what financial habits they have. Apart from that, all of this has to fit your business goals.

We can always help you with all the choices and more practical tasks. Don’t hesitate to reach out to us.